Meta (Facebook) Financial Analysis and Financial Ratios

Quality Business Consultant's financial analysis expert, Paul Borosky, MBA., doctoral candidate, and published author, has created proprietary financial models to help analyze Meta's (Facebook) financial performance using Meta's summarized income statements and balance sheets for the last five years, found in their Annual Reports and Amazon's 10ks.

Further, our financial model also calculates over 20 popular financial ratios, such as Meta (Facebook) current ratio, return on equity, and debt ratio. This information is the basis of our financial report, "Meta Financial Report," where we offer insights into understanding their financial standing through insightful financial analysis.

A Beginner's Guide to Meta (Facebook) Financial Analysis - 2021

- Included Easy to download PDF File.

- Included Easy to use format.

- Included Summarized Income Statements and Balance Sheets for the last 5 years..

- Included Popular financial ratios for the last 5 years included... with calculations and formulas!

- Included Expert tips to help with financial statements analysis.

- Included Expert tips to help with financial ratios analysis.

- NOT Included-Identify and discuss financial trends for the company..

- NOT Included-Expert financial analysis done by Paul Borosky, MBA.

- NOT Included- Analyst "Letter Grades" for the company's ratios.

Meta (Facebook) Financial Report by Paul Borosky, MBA. - 2021

- Included Easy to download PDF File.

- Included Easy to use format.

- Included Summarized Income Statements and Balance Sheets for the last 5 years..

- Included Popular financial ratios for the last 5 years included... with calculations and formulas!

- Included Expert tips to help with financial statements analysis.

- Included Expert tips to help with financial ratios analysis.

- Included Identify and discuss financial trends for the company.

- Included Expert financial analysis done by Paul Borosky MBA.

- Included Analyst "Letter Grades" for the company's ratios (Starting in 2021).

Meta (Facebook) Financial Report and Financial Analysis

Click Below for the CURRENT

Downloadable PDF Price!!

Meta (Facebook) Beginner's Guide 2021

Contents

- Disclaimer 3

- Forward 4

- Income Statement 6

- Meta’s Summarized Income Statements 6

- Revenues 6

- Cost of Goods Sold (COGS) 7

- Selling, General, and Administrative Expenses (SG&A 8

- Research and Development (R&D) 9

- Operating Expenses 10

- Earnings Before Interest and Taxes (EBIT 10

- Interest Expense 11

- Earnings Before Taxes (EBT) 11

- Taxes 12

- Net income 12

- Tax Rate 13

- Balance Sheet 14

- Meta’s Summarized Balance Sheets 14

- Cash 14

- Short-Term Investments 15

- Accounts Receivables 16

- Inventory 16

- Current Assets 17

- Property, Plant, and Equipment (PP&E) 18

- Total Assets 19

- Accounts Payable 20

- Accrued Expenses 21

- Short-Term Debt 21

- Total Current Liabilities 22

- Long Term Debt (LT Debt) 23

- Total Liabilities 24

- Common Stock and Additional Paid-in Capital 25

- Treasury 26

- Retained Earnings 27

- Total Equity 27

- Financial Ratios 29

- Meta’s Liquidity Ratios 30

- Current Ratio 30

- Quick Ratio 31

- Cash Ratio 32

- Meta’s Asset Ratios 33

- Total Asset Turnover 34

- Fixed Asset Turnover 34

- Days Sales Outstanding 35

- Inventory Turnover 36

- Accounts Receivable Turnover 37

- Accounts Payable Turnover 38

- Other Asset Ratio Calculations 38

- Working Capital Turnover 38

- Average Days in Inventory 39

- Average Days Payable 39

- Meta’s Profitability Ratios 40

- Return on Assets (ROA) 40

- Return on Equity (ROE) 41

- Net Profit Margin 42

- Gross Profit Margin 43

- Operating Profit Margin 43

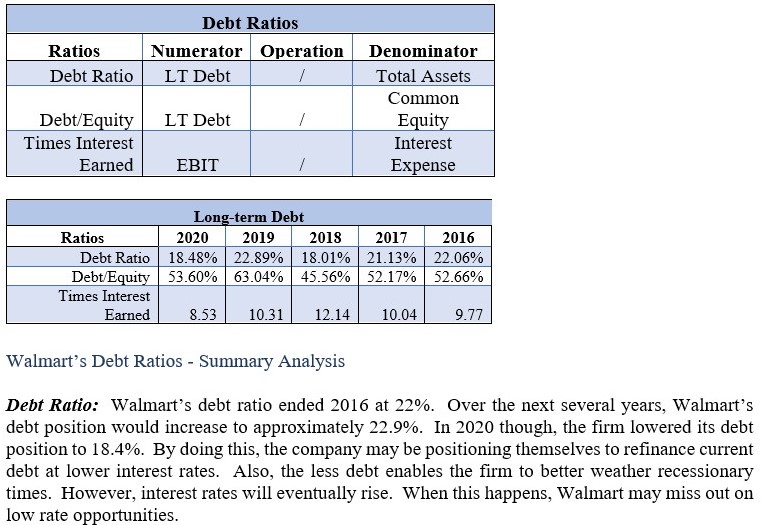

- Meta’s Debt Ratios 45

- Debt Ratio 45

- Debt to Equity Ratio 46

- Times Interest Earned 47

Click Below for the CURRENT

Downloadable PDF Price!!

Meta (Facebook) Financial Report 2021

Contents

- Disclaimer 3

- Forward 4

- Income Statement 6

- Meta’s Summarized Income Statements 6

- Revenues 7

- Cost of Goods Sold (COGS) 8

- Selling, General, and Administrative Expenses (SG&A 9

- Research and Development (R&D) 10

- Operating Expenses 11

- Earnings Before Interest and Taxes (EBIT 11

- Interest Expense 12

- Earnings Before Taxes (EBT) 13

- Taxes 13

- Net income 14

- Tax Rate 15

- Balance Sheet 16

- Meta’s Summarized Balance Sheets 16

- Cash 17

- Short-Term Investments 18

- Accounts Receivables 19

- Inventory 19

- Current Assets 20

- Property, Plant, and Equipment (PP&E) 21

- Total Assets 22

- Accounts Payable 23

- Accrued Expenses 24

- Short-Term Debt 25

- Total Current Liabilities 26

- Long Term Debt (LT Debt) 27

- Total Liabilities 28

- Common Stock and Additional Paid-in Capital 29

- Treasury 30

- Retained Earnings 30

- Total Equity 31

- Financial Ratios 33

- Meta’s Liquidity Ratios 34

- Current Ratio 34

- Cash Ratio 35

- Quick Ratio 36

- Meta’s Asset Ratios 38

- Total Asset Turnover 39

- Fixed Asset Turnover 40

- Days Sales Outstanding 41

- Inventory Turnover 42

- Accounts Receivable Turnover 43

- Accounts Payable Turnover 44

- Other Asset Ratio Calculations 45

- Working Capital Turnover 45

- Average Days in Inventory 45

- Average Days Payable 46

- Meta’s Profitability Ratios 47

- Return on Assets (ROA) 47

- Return on Equity (ROE) 48

- Net Profit Margin 49

- Gross Profit Margin 50

- Operating Profit Margin 51

- Meta’s Debt Ratios 53

- Debt Ratio 53

- Debt to Equity Ratio 54

- Times Interest Earned 55

- Summary 57

- Meta’s Strengths 57

- Meta’s Weaknesses 57

- Meta’s Final Grade 57

Meta (Facebook) Financial Report by Paul Borosky, MBA.

Hey All,

Thanks for considering my Meta Financial Report. In this report, you will be able to find preliminary information about Meta's current financial performance as well as some historical track records and trends. Also, in this report, written by myself, Paul Borosky, MBA., Doctoral Candidate and published author, you will find:

- Summarized income statement for the last 5 years.

- Summarized balance sheet for the last 5 years.

- Summary analysis by myself of the important income statement, balance sheet, and financial ratio trends and other happenings.

- Five years’ worth of over twenty common financial ratios presented with formulas, calculations, and analysis tips for each ratio.

- Line by line description, explanation, and analysis tip for most financial statement line items and financial ratios.

- Professional financial analysis tips are provided in each section to help YOU conduct your OWN financial analysis!

- Each section includes an “in other words” segment. This is where I use plain English to explain concepts.

Sincerely,

Paul, MBA.

Sample Report

Meta (Facebook) Income Statement Analysis Sample

In this section of the financial report, I walk you through a broad definition of what an income statement is and why it is essential. From this, I then discuss and define important income statement line items, such as revenues, gross profits, etc., in detail. Finally, I offer a summary analysis of the company's important income statement line item trends. For example,...

Meta Cost of Goods Sold.

Meta’s cost of goods sold (COGS) was $5.4 billion in 2017. As compared to revenues, its cost of goods sold was 13.4%. In the next four years, the company’s cost of goods sold would increase to $22.6 billion or 19.2% of revenues. This trend indicates that the cost of goods sold as compared to revenues was increasing at a faster pace as compared to the sales. This trend should concern investors. Eventually, Meta will need to increase product/service prices to better align with variable cost growth.

Analyst Grade: B

Meta (Facebook) 2021 Income Statement |

|||||

| Column1 |

2021 |

2020 | 2019 | 2018 |

2017 |

| Revenues |

117,929 |

85,965 | 70,697 | 55,838 |

40,653 |

| COGS |

22,649 |

16,692 | 12,770 | 9,355 |

5,454 |

| Gross Profit |

95,280 |

69,273 | 57,927 | 46,483 |

35,199 |

| SG&A |

9,829 |

6,564 | 10,465 | 3,451 |

2,517 |

| Depreciation |

7,967 |

66,862 | 5,741 | 4,315 |

3,723 |

| R & D |

24,655 |

18,447 | 13,600 | 10,273 |

7,754 |

| Other | |||||

| Total Operating Expenses |

42,451 |

91,873 | 29,806 | 18,039 |

13,994 |

| EBIT |

46,753 |

32,671 | 23,986 | 24,913 |

20,203 |

| Other Income | - | - | - | ||

| Interest Expense |

(531) |

(509) | (826) | (448) |

(391) |

| EBT |

47,284 |

33,180 | 24,812 | 25,361 |

20,594 |

| Taxes |

7,914 |

4,034 | 6,327 | 3,249 |

4,660 |

| Net Income |

39,370 |

29,146 | 18,485 | 22,112 |

15,934 |

Meta (Facebook) Balance Sheet Analysis Sample

In this section of the financial report, I walk you through a broad definition of what a balance sheet is and why it is important. From this, I then discuss and define important balance sheet line items, such as cash, inventory, etc., in detail. Finally, I offer a summary analysis of the company's important balance sheet line item trends. For example,...

Meta (Facebook) Property, Plant, and Equipment

Meta’s property, plant, and equipment (PP&E) were $13.7 billion, or 98% of sales in 2017. In the next several years, the company would increase its property, plant, and equipment to $57.8 billion or 136% of sales in 2021. This trend shows that the company is possibly underutilizing its fixed assets from the perspective of revenue generation. A better strategy would be for the company to divest underutilized fixed assets to better align their property, plant, and equipment with sales sustainability.

Analyst Grade: B

Meta (Facebook) 2021 Summary Balance Sheet |

|||||

| Column1 |

2021 |

2020 | 2019 | 2018 |

2017 |

| Cash |

16,601 |

17,576 | 19,079 | 10,019 |

8,079 |

| Short Term Investment |

31,397 |

44,378 | 35,776 | 31,095 |

33,632 |

| Account Receivable |

14,039 |

11,335 | 9,518 | 7,587 |

5,832 |

| Inventory | |||||

| Other | |||||

| Current Assets |

66,666 |

75,670 | 66,225 | 50,480 |

48,563 |

| Net PPE |

57,809 |

45,633 | 35,323 | 24,683 |

13,721 |

| Goodwill |

19,197 |

19,050 | 18,715 | 18,301 |

18,221 |

| Other | |||||

| Total Assets |

165,987 |

159,316 | 133,376 | 97,334 |

84,524 |

| Accounts Payable |

4,083 |

1,331 | 1,363 | 820 |

380 |

| Accrued Expense |

14,312 |

11,152 | 11,735 | 5,509 |

2,892 |

| Accrued Taxes | - | ||||

| Notes Payable | - | ||||

| LT Debt - Current | - | ||||

| Other | - | ||||

| Total Current Liabilities |

21,135 |

14,981 | 15,053 | 7,017 |

3,760 |

| LT Debt | |||||

| Other | |||||

| Total Liabilities |

41,108 |

31,026 | 32,322 | 13,207 |

10,177 |

| Common Stock |

55,811 |

50,018 | 45,851 | 42,906 |

40,584 |

| Treasury | - | ||||

| Retained Earnings |

69,761 |

77,345 | 55,692 | 41,981 |

33,990 |

| Other | |||||

| Total Equity |

124,879 |

128,290 | 101,054 | 84,127 |

74,347 |

| Total Equity & Liability |

165,987 |

159,316 | 133,376 | 97,334 |

84,524 |

Meta (Facebook) Financial Ratios Sample

In this section of the financial report, I walk you through definitions of various popular financial ratios, how to calculate the ratios, formulas used, etc. Also, for some popular financial ratios, I provide brief explanations of what the ratios mean as it is related to the company.

Meta (Facebook) Fixed Asset Turnover Ratio

Meta’s fixed asset turnover was 2.9 in 2017. In the next four years, the organization’s fixed asset turnover would fall to 2.04. This trend indicates the company may be underutilizing its fixed assets, specifically its property, plant, and equipment. Because of this issue, the firm may need to divest some underutilized fixed assets to best optimize its asset management practices. From an investor’s perspective, this is a poor trend.

Analyst Grade: B

Meta (Facebook) Return on Equity

Meta’s return on equity (ROE) was 21.4% in 2017. In 2021, the company’s return on equity was 31.3%. This trend indicates that the company is doing a good job of utilizing equity in financing revenue growth. However, the organization may be able to increase its return on equity by utilizing short-term and long-term debt for operations and growth opportunities. From an investor’s perspective, this is a below-average trend.

Analyst Grade: B

.

Meta (Facebook) 2021 Liquidity Ratios |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Current Ratio |

3.15 |

5.05 |

|||

| Cash Ratio |

2.27 |

4.14 |

|||

| Quick Ratio |

3.15 |

5.05 |

|||

| Net Working Capital |

45,531 |

60,689 |

|||

Meta (Facebook) 2021 Asset Utilization |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Total Asset Turnover |

0.71 |

0.54 |

|||

| Fixed Asset Turnover |

2.04 |

1.88 |

|||

| Days Sales Outstanding |

39.27 |

44.27 |

|||

| Inventory Turnover (Using Sales) |

#DIV/0! |

#DIV/0! |

|||

| Inventory Turnover (Using COGS) |

#DIV/0! |

#DIV/0! |

|||

| Accounts Receivable Turnover |

9.30 |

8.24 |

|||

| Working Capital Turnover |

2.59 |

1.42 |

|||

| AP Turnover |

8.37 |

12.39 |

|||

| Average Days Inventory |

#DIV/0! |

#DIV/0! |

|||

| Average Days Payable |

43.62 |

29.45 |

|||

Meta (Facebook) Profitability Ratios |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Return on Assets |

23.72% |

18.29% |

|||

| Return on Equity |

31.53% |

22.72% |

|||

| Net Profit Margin |

33.38% |

33.90% |

|||

| Gross Profit Margin |

80.79% |

80.58% |

|||

| Operating Profit Margin |

39.65% |

38.01% |

|||

| Basic Earning Power |

28.17% |

20.51% |

|||

| ROCE |

32.28% |

22.64% |

|||

| Capital Employed |

144,852 |

144,335 |

|||

| ROIC |

31.17% |

22.37% |

|||

Meta (Facebook) Debt Ratios |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Debt Ratio |

0.00% |

0.00% |

|||

| Debt/Equity |

0.00% |

0.00% |

|||

| Times Interest Earned |

(88.05) |

(64.19) |

|||